nc state sales tax on food

31 rows The state sales tax rate in North Carolina is 4750. The North Carolina NC state sales tax rate is currently 475.

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

FilePay Sales and Use Tax E-500 Pay a Bill.

. Click here for extremely detailed guidance on what grocery items are and are not tax exempt in New York. What is the sales tax in NC 2020. General Information Tax Rates Sales and Use Tax Forms and Certificates Technical Resources.

County and local taxes in most areas. The total North Carolina sales tax rate consists of the general and local rates. Prepared Food Beverage.

The Article 43 half-cent Transit. North Carolina Sales of grocery items are exempt from North. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

Counties and cities in North Carolina are allowed to charge an additional. Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. Georgia 4 Louisiana 4 North Carolina 425 4 Twenty-seven states the District of Colombia exempt food.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state.

NC State is not exempt from the prepared food and beverage taxes administered by local counties and. 3 In three states sales tax on food is levied only by local governments. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. Depending on local municipalities the total tax rate can be as high as 75.

The transit and other local rates do not apply to qualifying food. North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on.

Depending on local municipalities the total tax rate can be as high as 75. The exemption only applies to sales tax on food purchases. North Carolina sales tax details The North Carolina NC state sales tax rate is currently 475.

Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food. Exceptions include localities in Arizona Colorado Georgia Louisiana North Carolina and South Carolina where grocery food purchases are fully or partially exempt at the. A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in Cumberland.

The North Carolina NC state sales tax rate is currently 475. To calculate how much sales tax in North Carolina you should collect you must know the local sales tax rate of. A customer buys a toothbrush a bag of candy and a loaf of bread.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. This page describes the taxability of. Depending on local municipalities the total tax rate can be as high as 75.

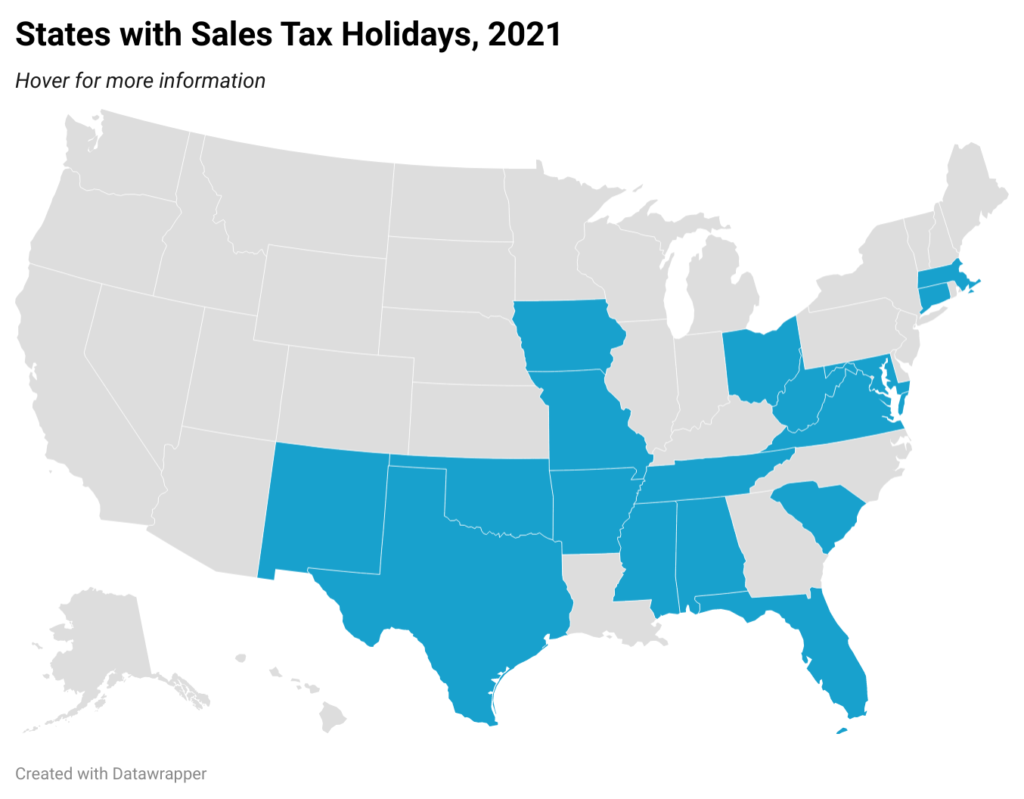

A Guide To State Sales Tax Holidays In 2022

States Without Sales Tax Article

Sales Tax On Grocery Items Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

How To Register For A Sales Tax Permit Taxjar

States With Highest And Lowest Sales Tax Rates

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Is Food Taxable In North Carolina Taxjar

States Without Sales Tax Article

North Carolina Sales Tax Small Business Guide Truic

What Is Sales Tax A Complete Guide Taxjar

States Without Sales Tax Article

Tax Friendly States For Retirees Best Places To Pay The Least

What Is Sales Tax Nexus Learn All About Nexus

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities